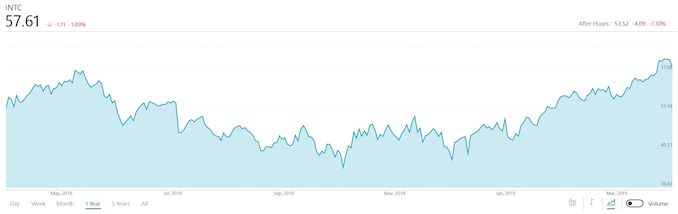

Intel Reports Q1 FY 2019 Results: Revenue Flat, PCs Up, Servers Down

by Brett Howse on April 25, 2019 9:45 PM EST- Posted in

- CPUs

- Intel

- Financial Results

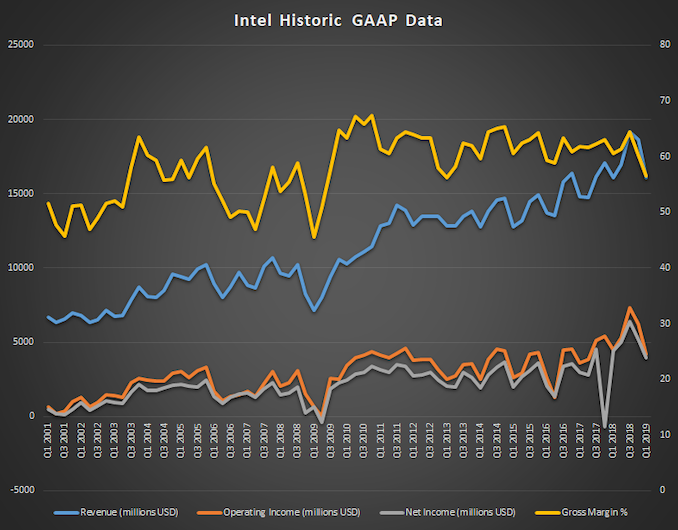

This afternoon, Intel announced their earnings for Q1 of their 2019 fiscal year. Revenue for the first quarter came in at $16.1 billion, which is flat compared to Q1 2018, but margins were down 4% to 56.6%. Due to this, operating income was down 7% to $4.2 billion, and net income was down 11% to $4.0 billion. Earnings-per-share for the quarter were $0.87, down 6% from $0.93 a year ago.

| Intel Q1 2019 Financial Results (GAAP) | |||||

| Q1'2019 | Q4'2018 | Q1'2018 | |||

| Revenue | $16.1B | $18.7B | $16.1B | ||

| Operating Income | $4.2B | $6.2B | $4.5B | ||

| Net Income | $4.0B | $5.2B | $4.5B | ||

| Gross Margin | 56.6% | 60.2% | 60.6% | ||

| Client Computing Group Revenue | $8.6B | -12% | +4% | ||

| Data Center Group Revenue | $4.9B | -20% | -6% | ||

| Internet of Things Revenue | $910M | +11% | +8% | ||

| Non-Volatile Memory Solutions Group | $915M | -17% | -12% | ||

| Programmable Solutions Group | $486M | -21% | -2% | ||

Despite a PC market that continues to struggle, Intel made gains in the first quarter with their Client Computing Group. On both notebooks and desktops, Intel volumes were down 7% and 8% respectively, but thanks to higher average selling prices (ASP) Intel’s PC-centric business did grow revenue. Notebook processor ASP was up 13% compared to Q1 2018, and desktop ASP was 7% higher. This increased revenue for this segment 4% overall to $8.5 billion. Intel cites strength in gaming, larger commercial, and modem for the growth.

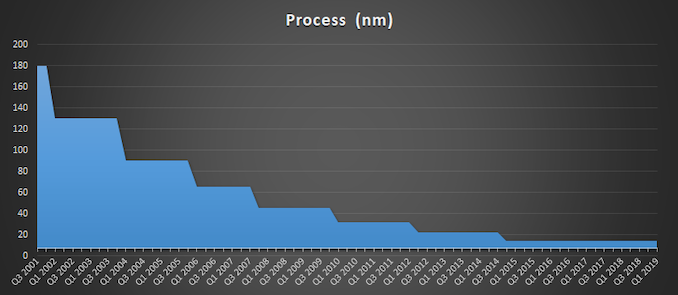

As we’ve already covered, Intel’s push to 10 nm has finally started to see some gains in volume after years of delay, and we should finally start to see Ice Lake powered laptops this fall.

Intel’s Data Center group was down 6% to $4.9 billion in revenue this quarter. Cloud continued to grow, up 5%, but it could not offset the decline in enterprise and government revenue, which was down 21% this quarter. At the end of the day, you can’t have both cloud and on-prem revenue gains forever, since the former is designed to eat the latter, but we’ll have to watch this over the next while and see if this is a one-year blip, or signs of a larger trend.

Internet of Things continued its growth, with revenue up 8% to $910 million. What was once a blip on the radar is almost a billion dollar per quarter market for Intel. MobileEye revenue was up 38% to $209 million, which is a record for this segment.

Intel’s non-volatile storage business was down 12% to $915 million, reflecting the increased competition in pricing of NAND.

Finally, Intel’s Programmable Solutions Group, which includes their Altera FPGAs, was down 2%.

Looking ahead to Q2, Intel is forecasting revenue of approximately $15.6 billion, with an operating margin of 27%, and the FY 2019 forecast is for approximately $69 billion in revenue, with an operating margin of 30%.

Source: Intel Investor Relations

18 Comments

View All Comments

Arbie - Thursday, April 25, 2019 - link

Wait til that 10 nm goodness hits the desktop next generation. Next human generation, that is.Sivar - Friday, April 26, 2019 - link

A bit optimisticSychonut - Friday, April 26, 2019 - link

Looking forward to 14+++++++.PeachNCream - Friday, April 26, 2019 - link

As long as they keep paying dividends on their shares, I do not care how many times they zap 14nm with the paddles to keep it alive.ksec - Friday, April 26, 2019 - link

>This increased revenue for this segment 4% overall to $8.5 billion. Intel cites strength in gaming, larger commercial, and modem for the growth.Intel had additional Modem business from Apple, that is anywhere between 30- 40M additional unit compared to last yea ( Last year was a split between Qualcomm and Intel )r. Or ~600M Revenue. If you had taken this out, Intel would have had ~4-6% lower revenue on the Client Computing Segment.

Again, Modem business is taking away capacity from DataCenter and Client Computing. It would have been much better had Intel planned their capacity ( or 10nm ) better.

The strange thing is AMD managed growth while Intel not losing much. The market as a whole seems extremely healthy.

ilt24 - Friday, April 26, 2019 - link

@ksec..."Intel had additional Modem business from Apple...."True, but I think your way off on your ~$600M in revenue number. Last year Apple sold around 52M iphones during the January quarter and they were said to have split demand between Intel and QCOM. In this year's January quarter they are expected to have sold closer to 42M units. which would put the increase in units at about 16M units which would put the Q to Q modem revenue bump around $240M around around 1.5%.

ksec - Friday, April 26, 2019 - link

Yes. Sorry I was thinking of Apple's Q1, and this is Intel's Q1 but Apple's Q2. Yes. The number should be much smaller.eva02langley - Friday, April 26, 2019 - link

Well, analysts are saying otherwise and expect desktop decreasing. Someone is lying... and we know who. Revenue are still the same because of shortages price premium.RSAUser - Wednesday, May 1, 2019 - link

Analysts prediction is definitely not as good as actual sales results.And it's been 4/5 years, upgrade cycles are going to start coming around now, especially since SSD wasn't really a thing a couple of years ago due to cost constraints.

DanNeely - Friday, April 26, 2019 - link

Modems would be done on RF processes. Those are different enough from what's used for CPUs that they need separate production lines. They only compete against each other in terms of capital spending and floorspace in a fab; you can't just stop making modems and start running wafers for desktop/server CPUs down the same lines.